Get Cash Payment Against Future Tax Liabilities*

30% eligible tax credit may be applicable.*Pending Legislation

Cool roof technology is a unique roofing alternative specifically designed to reflect maximum sunlight, absorbing significantly less heat than the standard roof. As a result, cool roofs provide various benefits for commercial buildings, including reduced energy use, reduced air pollution and greenhouse gas emissions, and improved human health and comfort. Read all about it here.

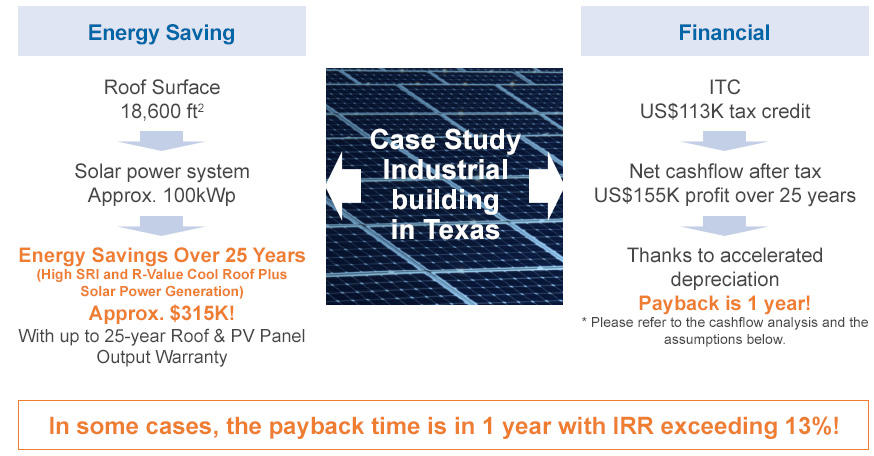

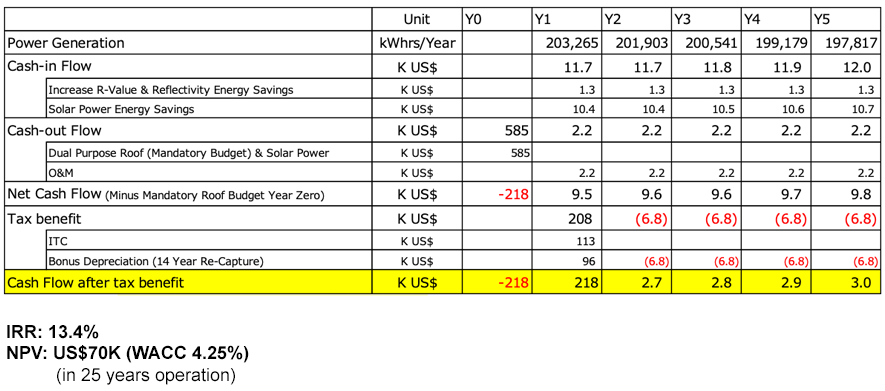

Kaneka Energy Management Solutions integrates energy generation into all types of commercial properties through advanced cool roof and bi-facial technology. Our dual-function building materials for commercial buildings result in massive savings for our clients, with a payback period as short as one year! Learn more about how cool roofs work, or contact our experts today to get started.

ADVANTAGES

Dual Purpose Roof and Solar Power Energy Solution

Leverage Your New Roof Budget into Virtually Free Solar Power

- KANEKAs bi-facial solar technology uses the Cool Roof surface to maximize power production together with energy savings in the building envelope.

- Investment Tax Credit (ITC) incentive is available in the U.S. for this unique dual-purpose system.

- ITC can be carried forward up to 20 years maximum.

ADVANTAGES

Dual Purpose Roof and Solar Power Energy Solution

Leverage Your New Roof Budget into Virtually Free Solar Power

- KANEKAs bi-facial solar technology uses the Cool Roof surface to maximize power production together with energy savings in the building envelope.

- Investment Tax Credit (ITC) incentive is available in the U.S. for this unique dual-purpose system.

- ITC can be carried forward up to 20 years maximum.